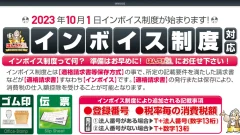

The invoice system ( qualified invoice storage system ) will start in October 2023, and many people may not know how it differs from the previous system. By understanding the invoice system, you can take correct measures regarding taxation. Also, be sure to understand the background behind the introduction of the invoice system and how to write it. In this article, we will explain the overview of invoices, how to write them, and their effects. If you are interested in the invoice system, please refer to it.

What is an invoice?

What will change when the invoice system is introduced? By knowing about invoices, you will be able to proceed with your work correctly and efficiently. First, I will explain the overview of invoices.

What is an invoice?

An invoice is a qualified invoice that accurately conveys sales tax. A number is assigned to each business operator and was established to accurately indicate the source of consumption tax. Although there are various opinions on the introduction of invoices, it can be said that it is a necessary system to properly manage consumption tax.

Businesses are divided into two categories: "taxable businesses" who must pay consumption tax, and "tax-exempt businesses" who are exempt from consumption tax. Up until now, both taxable and exempt businesses did not have to issue invoices, but from now on, taxable businesses will be required to issue invoices. Tax-exempt businesses are not obligated to issue invoices, but if the business partner is a taxable business, doing business with a tax-exempt business may result in a situation where you will not be able to claim a purchase tax credit.

Why was the invoice system created?

The invoice system was established to clarify the source of consumption tax, especially with the 10% consumption tax hike and introduction of reduced tax rate on October 1, 2019. It was decided to introduce invoices as a necessary measure. While it is said that the introduction of invoices is essential to increasing the transparency of transactions, it is also true that they have various effects.

In order to avoid panic after the introduction of invoices, you need to know the background behind the enactment of invoices.

What is input tax credit?

Purchase tax credit is calculated by subtracting the consumption tax amount of taxed purchases from the consumption tax amount of taxed sales. The invoice system allows buyers to save eligible invoices of sellers and use them as tax deductions. Consumption tax is a tax that is borne by consumers when they receive goods and services. Taxable businesses can also benefit from tax savings by receiving the purchase tax credit.

How to write an invoice (qualified bill)

In order to issue an invoice, it will not be effective unless it is issued according to the rules. The specified information must be filled out on the invoice and it must be delivered to the buyer. We will explain what should be written on invoices, changes from the past, and what you need to know about invoices.

About the information

The vendor issuing the invoice must fill in certain information. The required items are as follows.

- Date of transaction

- Contents of the transaction

- Issuing company name or company name, registration number

- Total amount of products divided by tax rate and applied tax rate

- Name or company name of the person receiving the document

- consumption tax

When issuing an invoice, the above information must be entered and issued.

Changes from the previous system

Until the introduction of invoices (qualified invoices), traditional invoices (classified invoices) were used. In addition to the separate invoice, there are some additional items that must be filled out. Similar to invoices, the name of the issuer or company, the details of the transaction, the month and date of the transaction, the name or company name of the recipient of the document, the total amount of the products, and the applied tax rate must be included in the classification invoice, just like invoices. was.

When the invoice system is introduced, new items will be required to be filled out, including ``registration number'', ``applicable tax rate divided by tax rate'', and ``consumption tax amount divided by tax rate''.

What you need to know

There are a few things you need to know when invoices are introduced. Many people think that invoices are only available in paper form, but electronic invoices are also available. You can also combine several documents to correspond to an invoice. Let's take a look at what you need to know about invoices.

Also available as electronic invoice

Invoices are also available as electronic invoices. There is no need to create all paper eligible invoices. Electronic invoices can also be sent via email or chat. The information on the e-invoice is the same as on paper.

By using e-invoicing, your work will be more efficient and your work will proceed more smoothly. However, when using electronic invoices, you need to be careful as a dedicated system is required. Additionally, the recipient of electronic invoices must store them in accordance with the Electronic Bookkeeping Law.

Possibility to combine several invoices

There is no problem even if the invoice contains information spread over several documents rather than a single document. For example, it can be used as an invoice even if the issuing company and transaction date are separated into different documents. However, in that case, you would need to show a relationship that is the same transaction. Please separate them clearly by delivery note number, etc.

Impact of the invoice system

The invoice system was established to clarify the source of consumption tax, but there are several effects of the invoice system. There are different impacts depending on tax-exempt and taxable businesses, and you need to understand what kind of impact each has.

If you are not aware of the effects of the invoice system, the purchase tax credit will not be applied and it will cause a burden on your business partners. Let's take a closer look at the impact of the invoice system on taxable businesses and tax exempt businesses.

Taxable person influence

Businesses with sales of 10 million yen or more are taxable businesses and must pay consumption tax. Taxable businesses must apply for registration because they are required to issue invoices. Businesses that have issued invoices are obligated to issue invoices (eligible invoices) when their business partners request them.

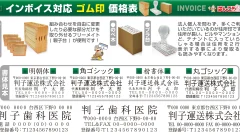

The main impact for taxable entities is likely to be an increase in work. Up until now, there has been no obligation to issue invoices, but the work will increase slightly from now on. In order to streamline work, it is necessary to use electronic invoices and prepare rubber stamps to proceed with work efficiently.

Impact of duty-free vendors

Businesses with sales of less than 10 million yen are tax exempt businesses and are exempt from consumption tax. This is the same as the previous system, and it can be said that businesses are not obligated to issue invoices. Tax-exempt businesses do not have to issue invoices, but there are some things to keep in mind.

Transactions between tax-exempt entities will remain unaffected.

However, if you are a tax-exempt business and do business with a taxable business, you will be greatly affected. This is because tax-exempt businesses cannot issue invoices, so taxable businesses with whom they do business are unable to deduct input taxes and are forced to bear the burden.

Therefore, there is a risk that transactions between tax-exempt businesses and taxable businesses that have been doing business until now will cease. This is a disadvantage for both parties, especially as it means that tax-exempt businesses may lose work.

If you wish to continue doing business with a taxable entity, you will be forced to choose between the two, as the tax exempt entity will also become a taxable entity and will need to issue invoices. In that case, you will have to pay the consumption tax that was previously exempted, which will have a big impact.

summary

Now that the invoice system has been introduced, you need to know about the invoice system so that you don't suddenly feel rushed. Taxable businesses and tax-exempt businesses have different impacts, and if you don't think about how to respond, you may suffer losses. The purchase tax credit will only be applicable if a qualified invoice can be issued, so please complete the application procedures in advance.

Hanko Shop 21 has a wide range of products that are compatible with the invoice system. Please consider it.

日本語

日本語 English

English 简体中文

简体中文 繁體中文

繁體中文 한국어

한국어 ไทย

ไทย Tiếng Việt

Tiếng Việt Indonesia

Indonesia Français

Français Español

Español Português

Português