When we hear about the invoice system, we are mainly talking about changes in items written on invoices, etc., but in reality, it also affects the information written on receipts. Therefore, in this article, we will also explain how to create receipts after the introduction of the invoice system.

What is the invoice system?

The invoice system will start from October 1, 2023 to clarify consumption tax. Unlike the traditional declaration method, if you do not include the number registered on the invoice by your business partner, you will not be able to receive the purchase tax credit and may incur losses.

What is the invoice system?

The invoice system is a system started to clarify the source of consumption tax between sellers and buyers. Under the previous system, there was no need to write down the "registration number" that was assigned when the invoice was registered, and it was possible to make purchase tax deductions based on the receipt.

However, once the invoice system was started, the number registered on the invoice was required, and if the information is missing and cannot be applied to a "qualified invoice," you will not be able to receive a purchase tax credit, resulting in a tax loss. I end up doing this. Therefore, when the invoice system starts, it is necessary to know the necessary information to be included in the documents, and it is necessary to submit all the information without missing anything.

Impact of the invoice system

The invoice system has several effects on both taxable and exempt businesses. We will introduce the effects of each.

Complicated work

The first is the increasing complexity of work. With the start of the system, businesses will be required to register invoices. Once you have applied for an invoice and obtained a registration number, there will be more work to fill out, and it is expected that your workload will increase considerably.

Therefore, it is necessary to understand invoices before invoices begin, and to create rubber stamps and stamps, improve systems, etc. in order to streamline operations. Invoices are not paper documents; electronic invoices are also possible. From now on, it will be necessary to proceed smoothly with tasks such as making good use of electronic invoices.

Decrease in jobs for duty-free traders

The second impact is that there is a risk of a decrease in work for tax exempt businesses. Businesses with income of less than 10 million yen will continue to be exempted from tax. Tax-exempt businesses do not need to issue invoices, so there is no need to apply for invoices or issue registration numbers. Therefore, the workload remains the same and there are no particular changes.

On the other hand, if you are a tax-exempt business operator and have been doing business with a taxable business operator, you need to be careful. Tax-exempt businesses cannot issue invoices, so if the buyer is a taxable business, they will not be able to claim input tax credit. In other words, the taxable entity will have to bear the tax amount that it had not borne before.

As a result, it is expected that a certain number of taxable businesses will reconsider their transactions with tax-exempt businesses, which will have a considerable impact on tax-exempt businesses. It is also true that we are being forced to choose between continuing to do business as a tax-free business, or becoming a taxable business, issuing invoices and paying consumption tax.

Invoice system and its impact on receipts

When the invoice system is introduced, it will affect both taxable and exempt businesses, increasing the complexity of work and reducing the number of jobs. Not only that, once the invoice system begins, the information on receipts will also change. Let's take a closer look to see what changes have been made to the receipt.

Applicable tax rate and registration number must be added

When the invoice system starts, in addition to the items previously recorded on receipts, items such as "registration number", "applicable tax rate", and "consumption tax amount divided by tax rate" will become mandatory. Registration numbers can only be issued to taxable businesses, not tax exempt businesses.

Therefore, if you were previously operating as a tax-exempt business and want to issue an invoice registration number, you will need to become a tax-exempt business. With the traditional receipt, the transaction partner cannot deduct the purchase amount, so you must consider whether you want to become a taxable entity.

Change in rounding method

There are also changes to how rounding is handled. Previously, there were no rules for rounding fractions of less than 1 yen, so it was possible to round each product individually. However, the invoice system stipulates that rounding is to be done once for each tax rate, and one invoice is to be rounded once.

The method of handling fractions remains the same as before, and businesses are free to decide on rounding, rounding down, rounding up, etc. Please note that rounding is no longer possible for each product.

A receipt for less than 30,000 yen is also required.

Previously, purchases of less than 30,000 yen could be deducted from purchase tax as long as they were recorded in the ledger even without a receipt, but with the introduction of the invoice system, 30,000 yen A receipt, which is an invoice, is required even if the amount is less than yen. Please note that if there is no receipt written on the invoice, the purchase tax credit will not be applied.

However, some receipts for less than 30,000 yen may be difficult to issue. Exceptions include train travel expenses, purchases from vending machines, unmanned sales, and services such as postal services, which are only allowed to be recorded in a book.

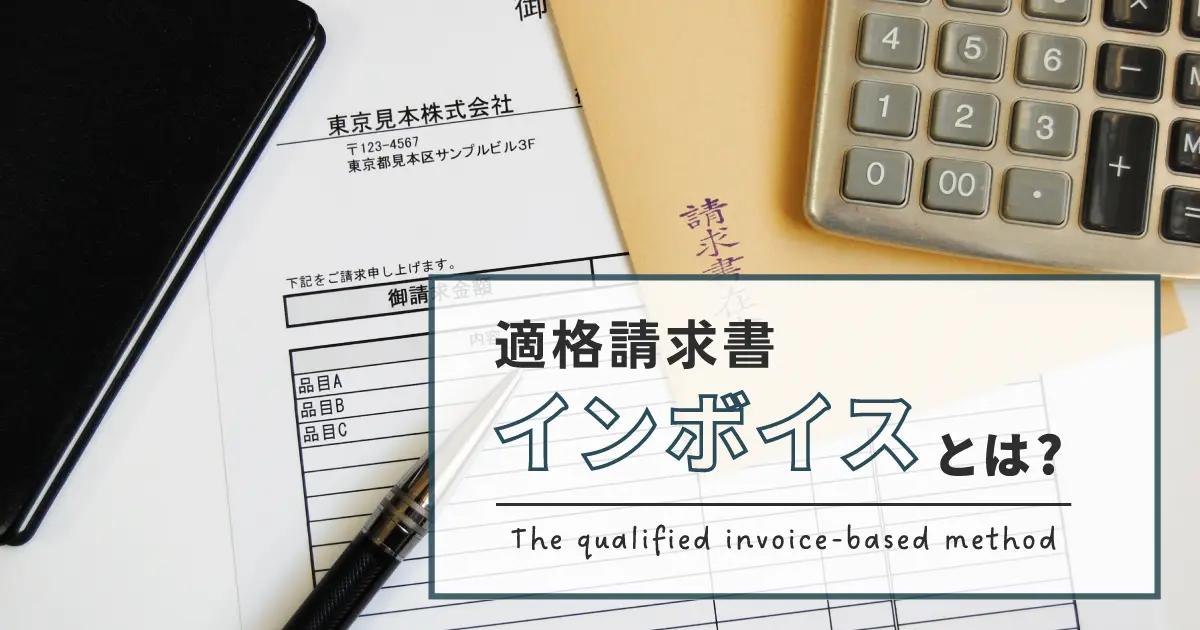

How to create a receipt compatible with the invoice system

We will explain how to create a receipt that is compatible with the invoice system. Receipts must be issued in an appropriate format in accordance with the information that meets the requirements for a qualified invoice. Let's take a look at the items that should be included on conventional receipts and the new items that need to be included.

Items to be included on traditional receipts

The items that should be recorded on the conventional receipt are as follows.

address

For the addressee, enter the name or company name of the payer to whom you are giving the receipt. In the case of a company name, there are ways to abbreviate it, but as a general rule, write the official name. As an exception, names may be omitted for taxi, travel, restaurant, retail, parking, and other businesses.

Transaction date

Enter the month and date when the transaction was made and the payment was received. It doesn't matter if it's in the Western or Japanese calendar, but it must be written accurately.

Transaction amount

Describe the amount of the transaction. Please enter the amount including tax and write it accurately to avoid any mistakes. To prevent fraud, the information may be separated by a comma (,), and a symbol such as "¥" may be added at the beginning and "*" at the end.

Proviso

We will describe the specific payment details. Examples of specific items include meal expenses, book expenses, stationery expenses, communication expenses, and consumables expenses. In the invoice system, payment details must be clearly stated as they are mandatory.

Issuer

Enter the publisher's information such as store name, company name, contact information, address, etc. You can write it down by hand or print it out. There are no particular rules.

Revenue stamp

Revenue stamps are required when purchasing goods or services worth 50,000 yen or more. You must affix a revenue stamp and affix HANKO on top of it. However, if payment is made by credit card or processed electronically, revenue stamps are not required.

Items that should be added after invoice processing

The following items will be added after the invoice system is applied.

Total amount and applicable tax rate

Due to the introduction of the reduced tax rate, there may be confusion between 10% consumption tax and 8% consumption tax. It is necessary to separate products that are eligible for the reduced tax rate and products that are not, and the total amount and applicable tax rate for each must be listed.

Please note that once the invoice system begins, the consumption tax amount must be recorded separately by tax rate.

Registration number

Once the invoice system starts, the registration number will also become a required item. The taxable person will be given a registration number, which must be noted on the receipt. Taxable businesses are required to register invoices, so those who are eligible should prepare early. It takes a certain period of time for the registration notification to arrive, so it is recommended that you apply in a planned manner.

summary

After the introduction of the invoice system, receipts will be allowed to be issued as qualified invoices if they meet certain requirements. Hanko Shop 21 also has receipts and rubber stamps that are compatible with the invoice system. If you are having trouble handling invoices, please contact Hanko Shop 21.

日本語

日本語 English

English 简体中文

简体中文 繁體中文

繁體中文 한국어

한국어 ไทย

ไทย Tiếng Việt

Tiếng Việt Indonesia

Indonesia Français

Français Español

Español Português

Português