Finally, an invoice system was introduced. When we hear the word invoice, we mainly refer to changes in the information on bills, etc., but in reality, it also affects the information on receipts and delivery notes. Therefore, in this article, we will also explain how to create a delivery note after the introduction of the invoice system.

Invoice system and statement of delivery

When the invoice system begins, the way delivery notes are written will change.If you don't have a clear understanding of what will change, you may end up losing money. We will provide an overview of the invoice system and explain its impact on delivery notes.

Invoice system and eligible invoices

An invoice is a qualified bill, such as a bill or statement of delivery that complies with the regulations of the invoice system. The invoice system was introduced to correctly indicate consumption tax and applicable tax rates between sellers and buyers. Under the previous system, if there was a receipt or invoice issued by the seller, it was eligible for purchase tax deduction, but with the start of the invoice system, the registration of businesses registered with invoices will be reduced. You will need a number.

Tax-exempt businesses do not need to register for invoices, but taxable businesses must register for invoices.

Impact on delivery notes

When the invoice system starts, the method of writing delivery notes will also change. Therefore, if a taxable business does not issue a statement of delivery that complies with the invoice system regulations, it will end up creating a statement of delivery that is not eligible for the purchase tax credit. In order to avoid causing inconvenience to business partners, it is necessary to check and respond to any changes and necessary items on the delivery note.

Impact on taxable and exempt businesses

The impact on the invoice system is different for taxable businesses and tax exempt businesses. As I mentioned earlier, taxable businesses are obligated to issue invoices (qualified invoices), and tax exempt businesses cannot issue invoices.

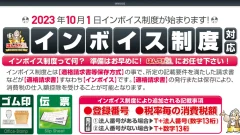

The introduction of the invoice system will likely have an impact on taxable businesses by making procedures more complicated and requiring more effort. Since it is now necessary to enter a registration number, which was not necessary before, many people are adopting electronic invoices or preparing rubber stamps in order to proceed efficiently.

Additionally, tax-exempt businesses may find it difficult to receive work. Until now, it was possible to deduct the amount of purchases if you had a delivery note or receipt, but from now on, you will not be able to deduct the purchase amount unless you have an invoice with the registration number written on it. In other words, since tax-exempt businesses cannot issue invoices, they cannot receive purchase tax credits, and their business partners will have to bear the cost. There is no problem when dealing with tax-exempt companies, but care must be taken when dealing with tax-exempt companies and taxable companies.

The only options are for the tax-exempt business to become a taxable business, or for the taxable business to bear the burden. If you are a tax-exempt business, consider carefully your relationship with your business partners and consider whether to become a tax-exempt business.

How to write a delivery note after the invoice system

After the invoice system, there are some changes to the way delivery notes are written. Broadly speaking, three items have been added: ``Invoice registration number,'' ``Applicable tax rate,'' and ``Consumption tax amount divided by tax rate.'' By adding these items to a traditional delivery note and issuing it, you can use it as a qualified invoice.

Let's check how to fill in the delivery note, taking into account the additional items to be written after the invoice system.

Date of transaction

As before, this is a required item. Enter the date on which the transaction was made and the payment was received. There is no particular specification such as Western calendar or Japanese calendar, so please be sure to write the year, month, and day accurately.

Transaction details

As before, this is a required item. You will need to write down the details of the transaction, including what you paid for.

Publisher's name or

As before, this is a required item. Enter the name and company name of the person who provided the product or service and issued the delivery note. There is no specific method of writing, such as handwriting or printing.

Name or company name of the person receiving the product or service

As before, this is a required item. Enter the name and company name of the person receiving the product or service. Basically, it is necessary to write the official name without abbreviations. However, depending on the industry, abbreviating the official name may be allowed. Official names can be omitted for taxi, retail, and restaurant businesses.

Registration number

This is a newly added required item. When you register for an invoice, a number will be assigned to each individual business owner and company. If an invoice number is issued by a business that is originally a corporation, it will be assigned a "T + corporate number," and if an individual business operator issues an invoice number, a "T + 13-digit number" will be assigned.

Registration of invoices takes time, so you must prepare in a planned manner. Taxable businesses that require invoice registration should apply early.

Total amount and applicable tax rate for each tax rate

This is a newly added required item. There are currently two types of consumption tax: the standard tax rate of 10% and the reduced tax rate of 8%. You must calculate the total by dividing these into each tax rate, and enter the transaction total, applicable tax rate, each consumption tax amount, and the total. The listed amount can be listed either including tax or excluding tax.

Points to consider when making a delivery note a qualified invoice

Just as an invoice can be made into a qualified invoice, a delivery note can also be made into a qualified invoice if the details are followed. Here, we will explain the points to consider when using a delivery note as a qualified invoice.

If multiple documents are required

Even if the invoice covers multiple pages, there is no problem as long as the information is filled out correctly. Depending on the number of products, it may not fit on one delivery note, so it is okay to have multiple eligible invoices. However, if you want to manage multiple documents, you need to clarify which documents you are dealing with. We must avoid managing them separately.

Transactions less than 10,000 yen

For payments of less than 10,000 yen, a statement of delivery issued by an invoice is not required. However, this is a transitional measure from October 2023 to September 30, 2029, and may change in the future. Receipts for invoices of less than 10,000 yen are not required, but they must be kept in the ledger as usual.

For transactions of less than 10,000 yen, businesses with taxable sales of 100 million yen or less are permitted to do so only by recording them in their books. Please note that not all businesses are eligible.

Points to note when using electronic invoices

Eligible invoices can be issued electronically instead of on paper. There is no problem as long as the required information is included in the email or electronic data. If the delivery note also contains the required information, it will be accepted as a qualified invoice.

However, in order to use electronic invoices, it is necessary to introduce a dedicated system, and preparations must be made in a planned manner. Digitization is essential to improve operational efficiency. Recipients who receive electronic invoices are required to preserve them in accordance with the Electronic Bookkeeping Act, so please double check.

Obey the newly established regulations

When the invoice system starts on October 1, 2023, you will no longer be able to receive a purchase amount deduction using the traditional method of filling in the delivery note. In order for a delivery note to be recognized as a qualified invoice, it is necessary to strictly adhere to the newly stipulated contents and create the delivery note. If you do not create an appropriate delivery note, it will cause inconvenience not only to you but also to the other party, so take this opportunity to understand the invoice system thoroughly.

summary

After the introduction of the invoice system, receipts will be allowed to be issued as qualified invoices if they meet certain requirements. Hanko Shop 21 also has receipts and rubber stamps that are compatible with the invoice system. If you are having trouble handling invoices, please contact Hanko Shop 21.

Related article

日本語

日本語 English

English 简体中文

简体中文 繁體中文

繁體中文 한국어

한국어 ไทย

ไทย Tiếng Việt

Tiếng Việt Indonesia

Indonesia Français

Français Español

Español Português

Português