Contents

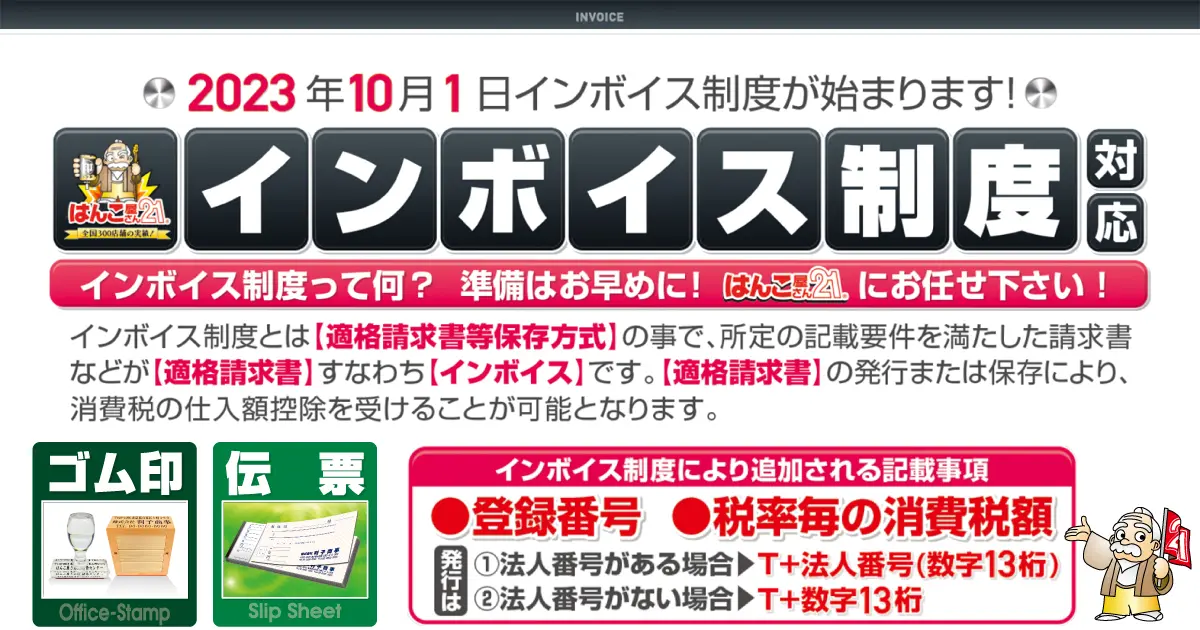

What is the invoice system?

Taxpaying businesses pay the amount after subtracting the consumption tax on purchases and expenses from the consumption tax on sales. This is called the purchase tax credit for consumption tax.

From October 2023, in order to receive this deduction, tax-paying businesses must do business with a supplier that is registered as a qualified invoicing business.

The invoice system is a method for storing qualified invoices, etc., and invoices that meet the specified requirements are "qualified invoices." By issuing or saving a qualified invoice, you will be able to receive a purchase amount deduction for consumption tax.

How the invoice system works

The invoice system will start in October 2023 as a method of purchasing tax credit for consumption tax. Only “qualified invoice issuing business operators” can issue qualified invoices, and in order to become a “qualified invoice issuing business operator”, you must apply for registration by September 30, 2023. You must submit a document and receive registration.

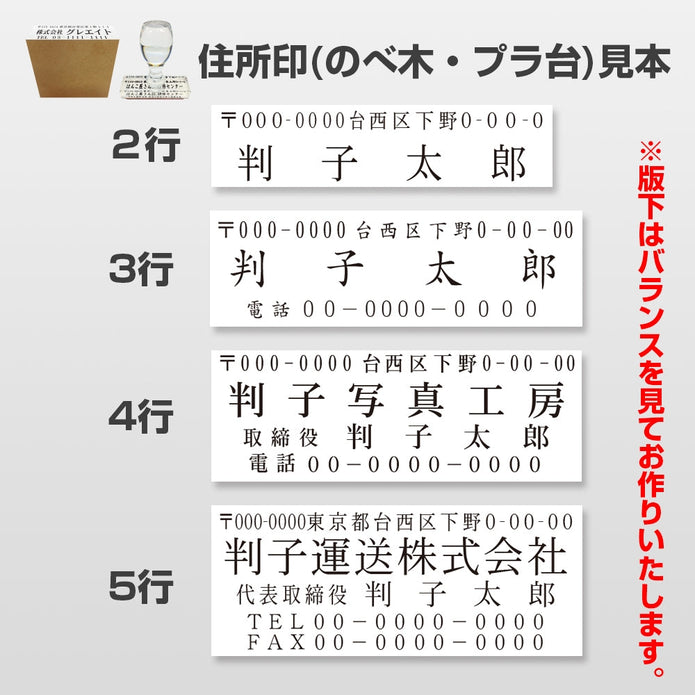

Example of filling out a qualified bill = invoice

Eligible invoices must include the registration number and consumption tax amount for each tax rate.

You must change your invoice or simple invoice to one with the corresponding information.

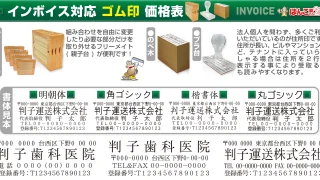

Introducing invoice compatible products

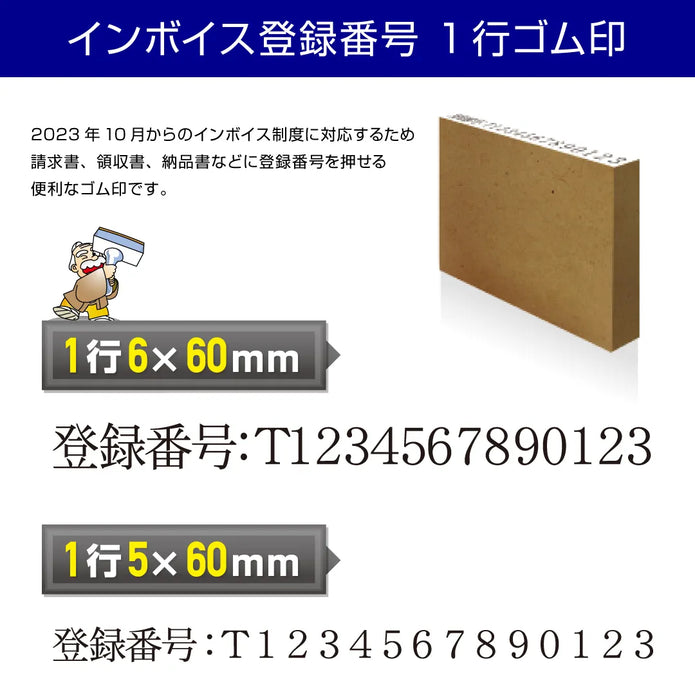

From October 2023, invoices and simple invoices must include the registration number and consumption tax amount for each tax rate.

At Hanko Shop 21, we have products that correspond to the items listed on the invoice.

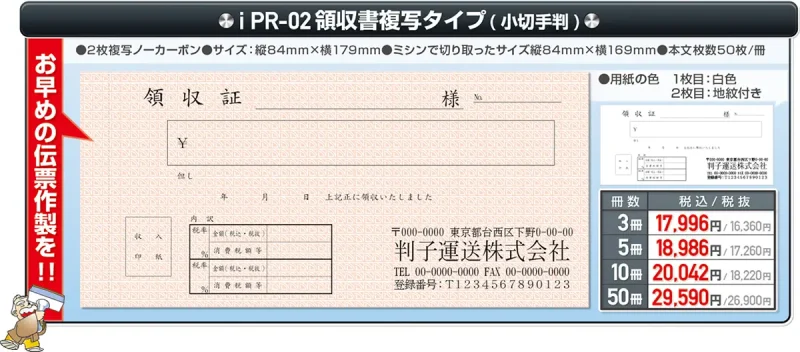

Invoice compatible "receipt"

iPR-02 Receipt copy type (check format)

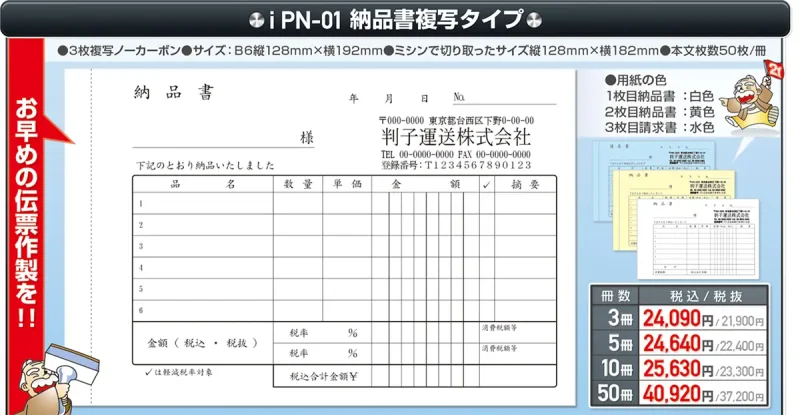

Invoice compatible “Delivery note”

iPN-01 Delivery note copy type

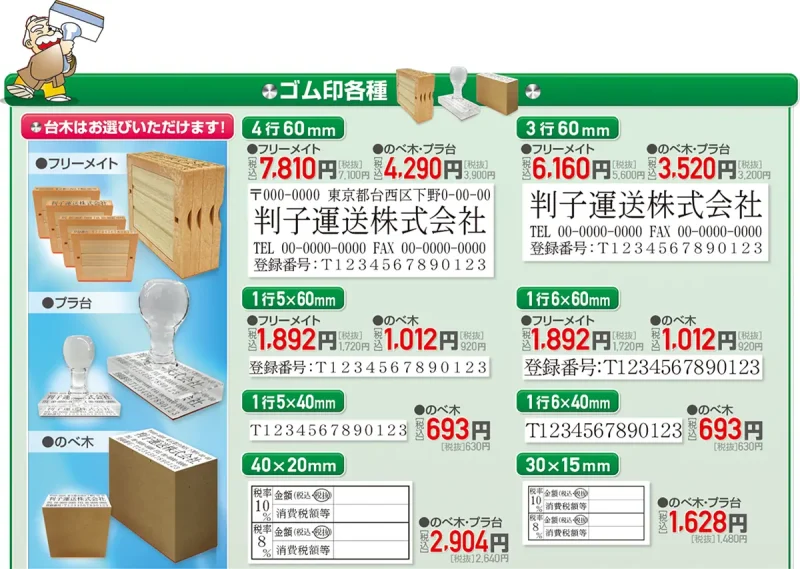

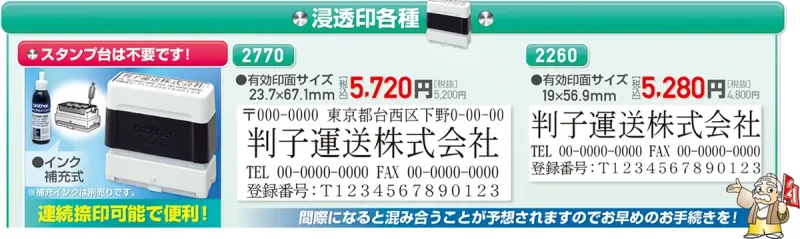

Invoice compatible “rubber stamp”

Invoice system Eligible invoice issuer registered sticker

This sticker allows customers visiting the store to register as a qualified invoice issuer and recognize the store/company as compatible with the invoice system.

Size: 110×90mm

Price: 550 yen (tax included)/piece

日本語

日本語 English

English 简体中文

简体中文 繁體中文

繁體中文 한국어

한국어 ไทย

ไทย Tiếng Việt

Tiếng Việt Indonesia

Indonesia Français

Français Español

Español Português

Português